Just last month, DMGS covered various cryptocurrency and blockchain legislation pending in state legislatures around the country. As another refresher, cryptocurrency is a digital or virtual currency secured by cryptography and based on blockchain technology. Blockchain is a decentralized technology spread across a myriad of computers that manage and record transactions and is known for its security. With the growing use of cryptocurrency and other digital assets, some have looked to the Biden Administration for guidance via a cryptocurrency executive order.

Since our last update, President Joe Biden signed an Executive Order on Ensuring Responsible Development of Digital Assets on March 9th.

Why Was There a Need for a Cryptocurrency Executive Order?

According to the White House, digital assets (including cryptocurrencies) have surged to over a $3 trillion market cap last November, up from $14 billion only five years ago. Estimates show that approximately 16% of – or 40 million – adult Americans have either invested in, traded, or used cryptocurrency at some point. Further, countries outside of the U.S. are looking at the possibility of Central Bank Digital Currencies, which are a digital form of a country’s sovereign currency.

As such, the White House argues a cryptocurrency executive order was needed in order for the U.S. to maintain “technological leadership” and “play a leading role in international engagement and global governance of digital assets consistent with democratic values and U.S. global competitiveness.”

What’s in the Executive Order?

Biden’s cryptocurrency executive order specifically calls for the following:

- Protect U.S. Consumers, Investors, and Businesses

- Directs the Treasury Department and other agency partners to assess and develop policy recommendations to address the implications of the growing digital asset sector and changes in financial markets for consumers, investors, businesses, and equitable economic growth.

- Biden’s EO further encourages regulators to ensure sufficient oversight and safeguard against any systemic financial risks posed by digital assets.

- Protect U.S. and Global Financial Stability and Mitigate Systemic Risk

- Encourages the Financial Stability Oversight Council to identify and mitigate systemic financial risks posed by digital assets and to develop appropriate policy recommendations to address any gaps in regulations.

- Mitigate the Illicit Finance and National Security Risks Posed by the Illicit Use of Digital Assets

- Directs a focus of coordinated action across all relevant U.S. Government agencies to alleviate the risks posed by any illicit use of digital assets.

- The EO additionally calls for agencies to work with U.S. allies and partners to make sure international frameworks, capabilities, and partnerships are aligned and responsive to such risks.

- Promote U.S. Leadership in Technology and Economic Competitiveness to Reinforce U.S. Leadership in the Global Financial System

- Directs the Department of Commerce to work across the federal government to establish a framework to drive U.S. competitiveness and leadership in, and leveraging of digital asset technologies.

- Such a framework shall serve as a starting point for agencies and integrate this as a priority into their policy, research and development, and operational approaches to digital assets.

- Promote Equitable Access to Safe and Affordable Financial Services

- Asserts the need for safe, affordable, and accessible financial services as a U.S. national interest that must inform our approach to digital asset innovation, including disparate impact risk.

- The Order calls for the Secretary of the Treasury, alongside all relevant agencies, to generate a report on the future of money and payment systems, to include implications for economic growth, financial growth and inclusion, national security, and the extent to which technological innovation may influence that future.

- Support Technological Advances and Ensure Responsible Development and Use of Digital Assets

- Directs the U.S. Government to study and support technological advances in the responsible development, design, and implementation of digital asset systems but at the same time must prioritize privacy, security, combating illicit exploitation, and reducing negative climate impacts.

- Explore a U.S. Central Bank Digital Currency (CBDC)

- The EO directs the U.S. Government to evaluate the technological infrastructure and capacity needs for a potential U.S. CBDC in such a way that protects Americans’ interests.

- The EO further encourages the Federal Reserve to continue its research, development, and assessment efforts for a CBDC in the U.S., such as the development of a plan for broader U.S. Government action in support of their work.

Latest News

Photo credit: iStock.com/Funtap As cryptocurrency continues to shape global financial systems, U.S. states are increasingly introducing legislation to regulate its use. From allowing payments in digital currencies to banning cryptocurrency ATMs, state governments are focusing [...]

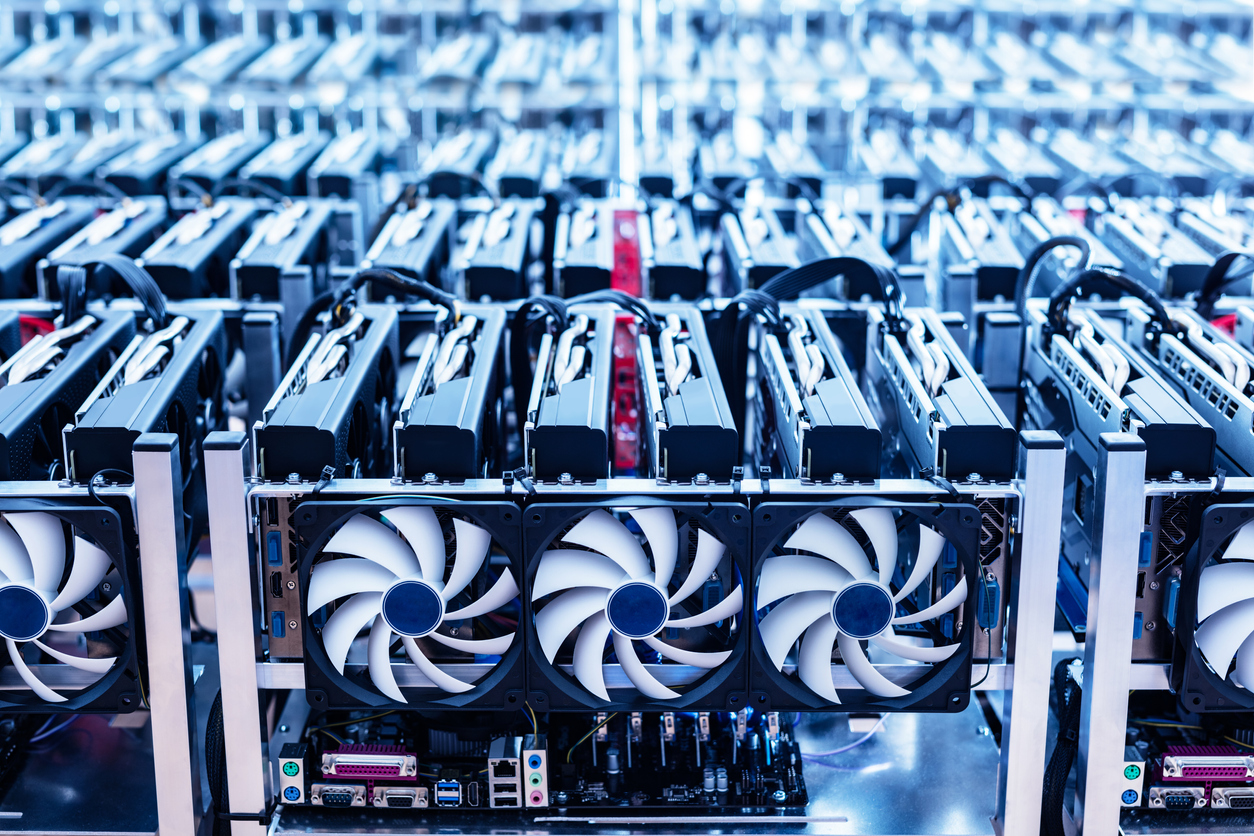

Photo credit: iStock.com/NiseriN As the calls for cryptocurrency regulations heat up, several state legislatures are jumping ahead, clarifying their existing laws and providing protections for digital asset miners and cryptomining. Cryptomining, or digital asset mining, [...]

Photo credit: iStock.com/TU IS New Hampshire Executive Order Background In February 2022, New Hampshire Governor Chris Sununu (R) issued Executive Order 2022-1, establishing the Governor’s Commission on Cryptocurrencies and Digital Assets. The order noted that [...]

Photo credit: iStock.com/Andrii Dodonov As we discussed previously, on August 24, 2022, President Joe Biden announced a sweeping package of federal student loan relief that forgives as much as $20,000 in loans, a move Biden said would [...]

Stay In Touch