As cryptocurrency continues to shape global financial systems, U.S. states are increasingly introducing legislation to regulate its use. From allowing payments in digital currencies to banning cryptocurrency ATMs, state governments are focusing on balancing innovation with consumer protection. This article examines the latest cryptocurrency legislation across several states—Arizona, Kansas, New Jersey, New York, and Virginia. Understanding these bills and their implications is crucial for staying informed about cryptocurrency’s evolving role in the public and private sectors.

Arizona’s Cryptocurrency Payment Bill

Arizona SB 1128, introduced in the 2024 legislative session, aims to modernize the state’s payment systems by allowing state agencies to accept cryptocurrency for various obligations such as fines, taxes, fees, and penalties.

Under the proposed law, state agencies would have the authority to collaborate with cryptocurrency service providers to accept digital currencies like Bitcoin, Ethereum, Litecoin, and Bitcoin Cash. The service provider would be responsible for converting cryptocurrency to U.S. dollars or managing payments directly in digital currency. The bill also stipulates that the state or the person making the payment could cover any service fees associated with the cryptocurrency transaction.

The bill passed the Senate but did not advance through the House in 2024.

Kansas’ Bill for Cryptocurrency Ban in Campaign Finance

Kansas HB 2535, introduced in the 2024 legislative session, proposed significant changes to the state’s campaign finance laws, with a strong focus on regulating the use of cryptocurrency in political campaigns. The bill introduces a comprehensive prohibition on the use of cryptocurrency for campaign contributions. Under the proposed law, no person or entity could make or accept contributions in cryptocurrency for any candidate, candidate committee, political committee, or party committee. Additionally, the bill prohibits candidates or their committees from holding any campaign assets in cryptocurrency, effectively banning the use of digital currencies in all facets of campaign finance.

The bill did not advance in the 2024 legislative session.

New Jersey’s Legislation Would Ban Cryptocurrency ATMs

Two identical bills in New Jersey, S3694/A4880, aim to address the rising number of scams associated with cryptocurrency automatic teller machines (ATMs). The bills propose a complete ban on cryptocurrency ATMs in the state, making it illegal for any business entity to own, control, install, manage, sell, or offer these machines for sale.

The bills would define cryptocurrency ATMs as physical, internet-connected kiosks that allow users to buy, sell, send, or receive digital currencies like Bitcoin using cash, debit, or credit cards. The bills would find that, according to the U.S. Federal Trade Commission (FTC), losses from scams involving cryptocurrency ATMs surged to more than $110 million in 2023. They surpassed $65 million in just the first half of 2024. The bills highlight that individuals aged 60 and older are three times more likely to be victims of these scams, with median losses of $10,000.

The bills seek to protect consumers from these frauds by classifying the operation of cryptocurrency ATMs as an unlawful practice under New Jersey’s Consumer Fraud Act. Violators could face fines of up to $10,000 for a first offense and $20,000 for subsequent violations. Additionally, the bill allows for further penalties, including cease-and-desist orders, punitive damages, and treble damages awarded to victims.

Neither bill had advanced as of October 2024.

New York’s Cryptocurrency Payment Bill

In New York, Assembly Bill 2532 was introduced in January 2024 to modernize the state’s payment system by allowing state agencies to accept cryptocurrencies. Under the legislation, individuals and entities could use digital currencies like Bitcoin, Ethereum, and Litecoin to pay various state-related expenses, including fines, taxes, fees, and other financial obligations.

The bill would also allow state agencies to establish agreements with cryptocurrency issuers or individuals to accept payments in crypto. However, these transactions would only be finalized once the state received full payment from the cryptocurrency issuer, ensuring security and compliance. Agencies may also impose service fees to cover transaction costs, providing flexibility in managing crypto payments.

If enacted, the law will take effect 90 days after becoming official. The bill had not advanced past its committee of origin as of October 2024.

Virginia’s Blockchain and Cryptocurrency Study

Approved by Governor Glenn Youngkin (R) on April 8, 2024, SB 439 directs the Joint Commission on Technology and Science (JCOTS) to study the use of blockchain technology and cryptocurrency in the Commonwealth. The bill tasks JCOTS with conducting comprehensive analysis, in consultation with the State Corporation Commission and other key stakeholders, to evaluate both the risks and benefits of blockchain and cryptocurrency in government and business sectors.

The analysis will cover several key areas:

- • The potential privacy risks and advantages of using blockchain technology in state and local governments and businesses.

- • The impact of the cryptocurrency industry on Virginia’s economy, specifically focusing on its effects on state revenues and energy consumption.

Additionally, JCOTS will assess the viability of creating a Blockchain and Cryptocurrency Commission, which would develop recommendations for using and regulating these technologies within the Commonwealth. The Commission would also explore other related topics regarding blockchain and cryptocurrency as necessary.

JCOTS must present its findings and recommendations in a report to various legislative committees by December 1, 2024, helping to inform future policymaking on these emerging technologies in Virginia.

From The Experts

Expert insights from the authors at Duane Morris Government Strategies.

Ryan Stevens

As states grapple with the rise of cryptocurrency, it’s crucial to strike a balance between fostering innovation and ensuring consumer protection. The recent wave of cryptocurrency legislation reflects both the opportunities and challenges this technology presents at the state level.

Latest News

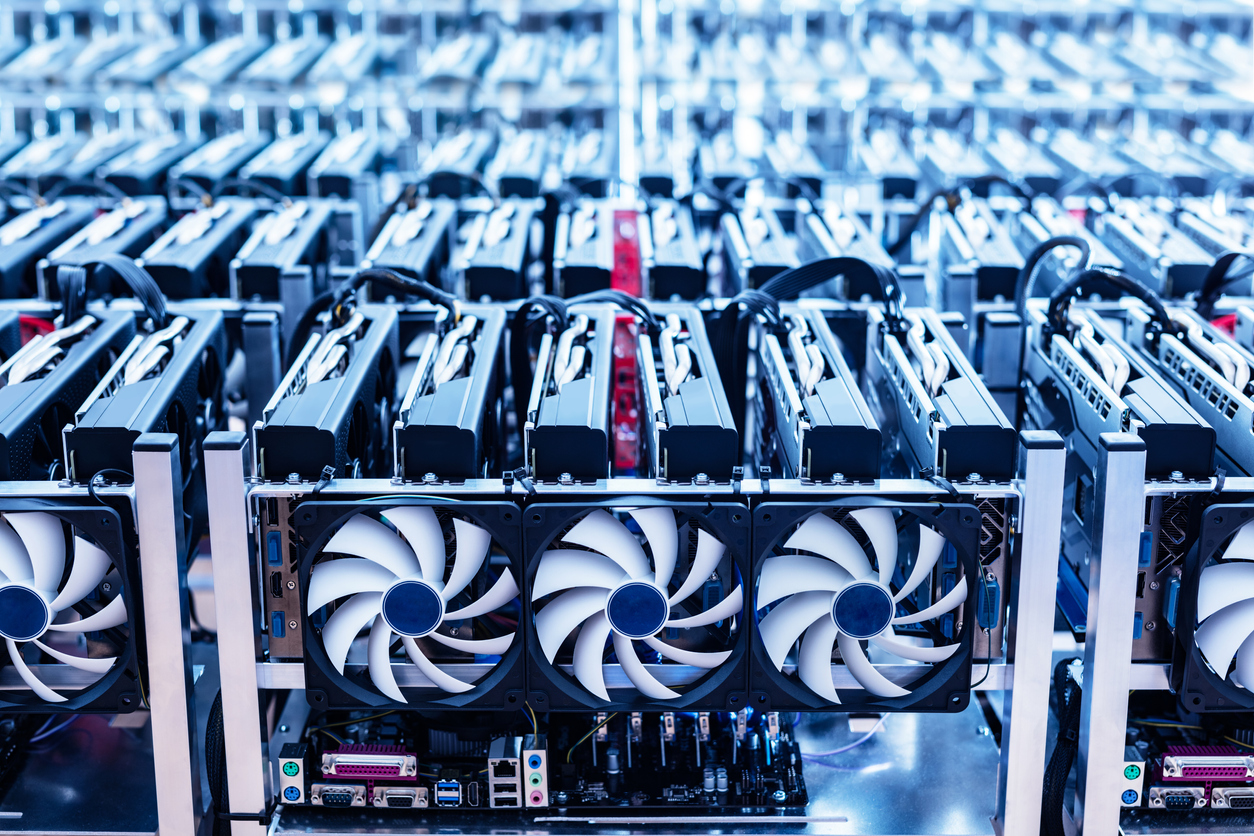

Photo credit: iStock.com/NiseriN As the calls for cryptocurrency regulations heat up, several state legislatures are jumping ahead, clarifying their existing laws and providing protections for digital asset miners and cryptomining. Cryptomining, or digital asset mining, [...]

Photo credit: iStock.com/TU IS New Hampshire Executive Order Background In February 2022, New Hampshire Governor Chris Sununu (R) issued Executive Order 2022-1, establishing the Governor’s Commission on Cryptocurrencies and Digital Assets. The order noted that [...]

Photo credit: iStock.com/Andrii Dodonov As we discussed previously, on August 24, 2022, President Joe Biden announced a sweeping package of federal student loan relief that forgives as much as $20,000 in loans, a move Biden said would [...]

Photo credit: iStock.com/Sergey Demchenko Many states are ending the 2022 fiscal year with a budget surplus, resulting in significant legislative deliberations about the best way to utilize those funds. During the fiscal year 2021, some [...]

Stay In Touch