It is no secret that the economic model of the United States has undergone dramatic changes over the course of the last fifty years.

According to the United States Bureau of Economic Analysis (BEA), in 1966, the industrial sector of the economy made up more than a third of the Gross Domestic Product. Fast forward to 2016, and these manufacturing jobs account for less than 18% of GDP.

Meanwhile, the service sector grew from about half of GDP in 1966 to more than two-thirds by 2016.

Not only have these changes impacted the kinds of jobs we have, but they have also forced policymakers to reconsider the basic tax structure upon which they fund state governments.

To date, only Hawaii, New Mexico, and South Dakota have levied taxes on services across the board, with a number of states selectively taxing certain types of services. That balance could be shifting in the coming years.

In today’s legislative update, we review a Utah proposal aimed at doing just that. These policy battles are just the latest in a series of debates that will undoubtedly continue as the service economy continues to grow.

While many states around the country have debated over how to adjust their tax system to fit the 21st century service-based economy, Utah finds itself in a unique situation.

Income Tax v. Sales Tax in Utah

In an odd set of circumstances, the state has the ability to give nearly $225M in tax breaks, but simultaneously cannot afford to fully enact a Medicaid expansion that the voters approved last year.

This is due to Utah’s tax structure.

Under the Utah Constitution, funds generated from the state’s income tax are required to be spent on basic education. This definition has been expanded to also include higher education, but lawmakers are unable to spend these funds on other state projects.

Thanks to steady population growth, and well-managed expansion, the income tax has generated a nearly $1 billion surplus this year in the state’s education fund. While lawmakers plan to drive nearly $500M of that money into funding boosts for education, they wish they could put the balance towards other critical projects.

Nearly the entirety of the remaining functions of state government are currently funded by the sales tax. This fact has driven Utah lawmakers to consider a significant expansion of the sales tax to capture currently exempted services.

According to the Governor’s Office of Management and Budget, economic transactions covered by the sales tax in the 1980’s constituted more than 70% of the economy as measured by personal income. Today, this number has fallen to just over 40%.

These challenges are not new, but supporters of reform claim that a crisis is very near on the horizon thanks to the shift in funding mechanisms for higher education.

Prior to 1996, income tax funds were exclusively reserved for K-12 education, while Higher and Technical education were funded through the sales tax funds, along with the rest of state government. A voter-backed initiative in 1996 provided the state government with some flexibility, permitting higher education to be funded through a mix of income and sales tax funds.

Splitting the cost of higher education between the two funds relieved pressure on both the higher education institutions and the state’s sales tax funds. However, as the sales tax base has continued to weaken, the higher education budget has been increasingly supported with income tax funds.

Advocates of reform claim that once they reach the point that the entirety of the higher education budget is funded with income tax dollars, Utah lawmakers lose the budget flexibility that has allowed them to avoid dangerous shortfalls.

The Proposed Solution

In order to correct the problems posed by Utah’s current tax structure, the Governor and lawmakers have proposed a vast expansion of the state’s sales tax.

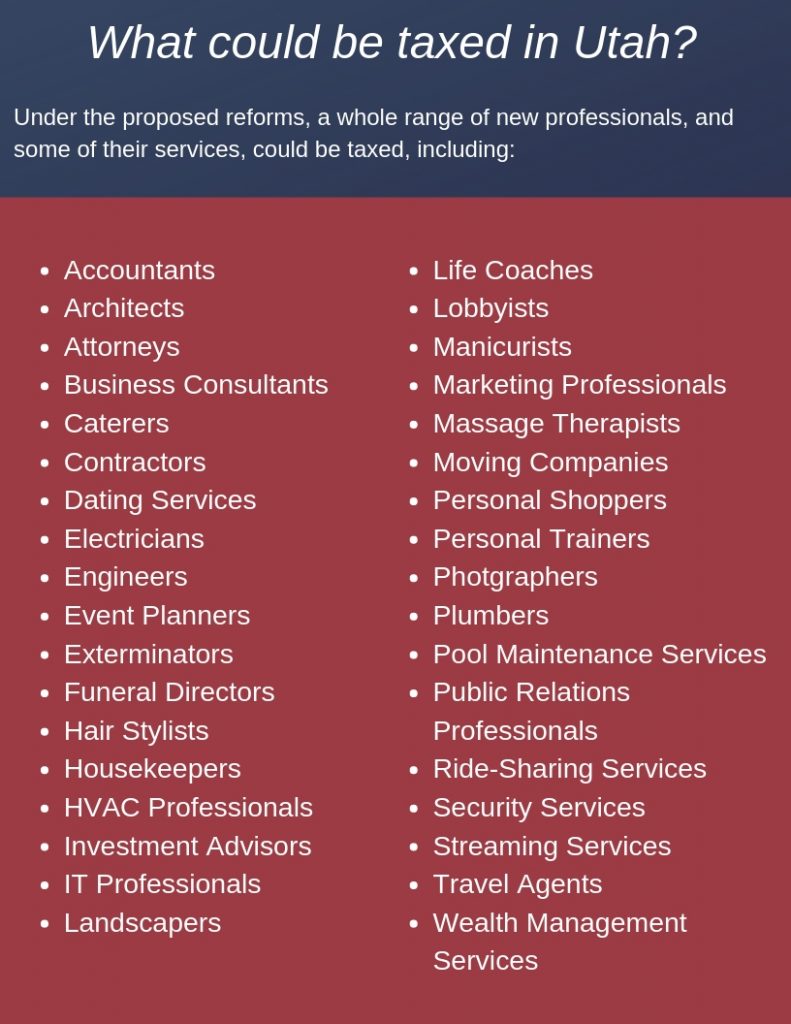

In late February, lawmakers revealed the results of their conversations between the legislative and executive branches, in the form of HB441. Their series of proposed changes included:

- Expanding the sales tax to cover a wide range of services including (but certainly not limited to) legal services, construction, haircuts, landscaping, ride-sharing, and financial services

- Realtors would largely be exempted from these changes, but a new .075% transfer tax would be imposed on all commercial and residential property sales

- Specific medical services would also be excluded from the sales tax, but a new 1% premium would be imposed on medical insurance

- Tuition and rent payments would also be exempted

In order to keep this proposal budget-neutral for this year, these new taxes would be offset in the short term but tax credits and additional tax cuts, including:

- Lowering the sales tax to 3.1% from 4.7%

- Lowering the personal income tax rate to 4.75% from 4.95%

Shortly after these details were made public, Rep. Tim Quinn, the bill’s sponsor, was quoted as saying “We tried to piss everybody off equally, so that we weren’t picking winners and losers. And it is working.”

Status & Next Steps

In early March, Governor Herbert and legislative leaders announced that their plans to overhaul the tax code, including these reforms, were not going to materialize in this session of the legislature.

The State House was able to pass the measure, but it failed to earn enough votes in the Senate ahead of the March 14th deadline.

Under the Utah Constitution, the annual legislative session begins on the fourth Monday of January, and is convened for 45 calendar days. The session and its business must be concluded before midnight on the 45th day.

However, the Governor is empowered to call a special session, to last no more than 30 calendar days, with a specifically outlined purpose.

With an eye towards a special session later this year, a task force has been formed to study the issue and report back to the Governor and the Legislature as to the potential next steps.

This task force will be made up of five State Representatives, five State Senators, and up to four non-voting members. They have been tasked with embarking upon a state-wide listening tour, collecting feedback from taxpayers and businesses, and then issuing a series of recommendations.

While HB441 is certainly the starting point for the conversation, the Governor has made it clear that everything must be on the table. This could include a full sales tax on food, new funding sources for transportation and infrastructure, and even a constitutional amendment to allow the income tax funds to be spent elsewhere in the state’s budget.

Once the recommendations have been issued, the Governor plans to call a special session of the legislature, as outlined above, to deal with the issue of revenue imbalances in the state.

This will be an important issue to watch over the coming months as the task force studies these issues and the Governor and Legislature consider options to deal with the economic challenges facing Utah in the 21st century and beyond.

Latest News

photo credit: iStock.com/designer491 According to the National Center for Education Statistics, “Property taxes contribute 30% or more of total public-school funding in 29 states.” However, using property tax income to fund public schools can be [...]

Film strip in perspective. 3D isometric film strip. Cinema Background. Template cinema festival or presentation with place for your text. Movie time and entertainment concept. Vector illustration The Georgia film tax credit was designed to [...]

Photo credit: iStock.com/gorodenkoff Since the 1990s, states have offered incentives to lure production companies from other states into their own. In 2020, the U.S. film entertainment revenue amounted to nearly $26 billion. Although in the [...]

Digital collage by Ryan Stevens; image source by KaraSuva from Pixabay On November 19, 2021, the House passed a $2 trillion reconciliation bill—the Build Back Better Act—to implement key elements of President Joe Biden’s economic [...]

Stay In Touch